BMI View: The PBoC has tightened the reins on the CNY following a period of uncertainty in the wake of its August devaluation, and appears unlikely to allow an acute depreciation in the near-future. As such, we have shifted back our expectations for yuan weakness, but still expect the currency to depreciate over the coming quarters. With market forces strongly to the downside, we now forecast the yuan to weaken to CNY6.5500/USD by the end of 2015, before depreciating further towards our end-year target of CNY6.8000/USD by end-2016.

Short-Term Outlook (three-to-six months)

The Chinese yuan has regained stability following a short period of acute turbulence in the wake of the PBoC's August 11 devaluation. Judging by the massive drop in the PBoC's foreign exchange reserves in August, however, as well as the offshore and forward markets, we believe that pressure on the currency remains firmly to the downside. While much of the currency's near-term performance is down to the extremely opaque whims of the PBoC, it appears unlikely that the central bank will allow an aggressive depreciation over the next three-to-six months. As such, we have upgraded our end-2015 forecast for the yuan to CNY6.5500/USD.

Not Quite Ready For Liberalisation

China - Exchange Rate, CNY/USD

Source: BMI, Bloomberg

Long-Term Outlook (six-to-24 months)

While we have upgraded our forecast for 2015, this is merely a matter of timing, and we believe that broad downside pressures will force the yuan lower over the next 12 months. We have therefore shifted our depreciatory expectations back slightly, and now see the yuan weakening to CNY6.8000/USD by the end of 2016.

It has been a particularly eventful three months for the Chinese yuan, which has swung from a hard US dollar peg in July to a two-day, 3.5% devaluation in August, followed by a testing period in which the PBoC was forced to heavily intervene in order to prevent a more acute sell-off. The chain of events beginning in August, when the central bank decided to break the currency's month-long hard-peg against the US dollar, shocked global financial markets and sent the yuan reeling for its worst two-day loss in more than a decade. Indeed, the reaction by global financial markets, as well as market participants, finance ministers, and politicians, was so severe that we believe it surprised even the PBoC, which immediately set out to stabilise the currency and to reassure investors that it would not send the CNY any weaker over the near-term.

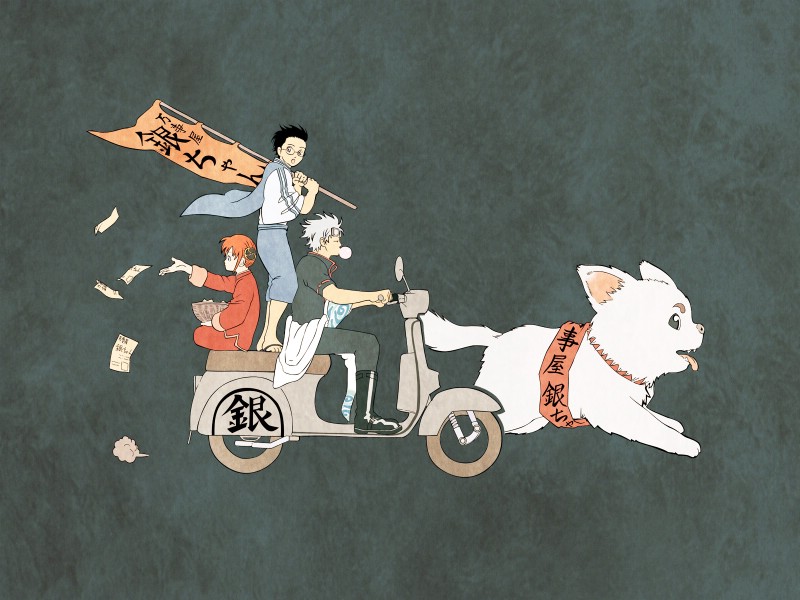

Reunification

China - Exchange Rate, CNY/USD & PBoC CNY Midpoint & Spread

Source: BMI

PBoC Playing It Safe For Now

The PBoC has since stuck to this position, which calls into question its assertion that it had adopted a more liberal currency regime for the yuan beginning on August 11. Indeed, a core tenet of the PBoC's more liberal stance on the yuan is to allow it to trade within a ��2% daily range (versus the central bank's daily midpoint setting for the currency, known as the CNYM). However, the currency has stuck very closely to the midpoint dating back to mid-August, so much so that the spot exchange rate and the CNYM have effectively been unified. While this technically could have been the result of the PBoC's new daily fixing mechanism (under which the central bank claims to base the CNYM on the previous day's close), it is more likely that the currency has simply been kept on a tight leash since August's acute volatility, and this is corroborated by the fact that the intraday range on the yuan has also been very tight.

Market Instruments All Point Towards Depreciatory Pressure

Other factors also point towards significant PBoC support for the CNY. The central bank's foreign exchange reserves fell by a record USD93.9bn in August, underscoring the massive scale of its open market operations (part of the dramatic decline can also be attributed to capital outflows amid acute financial market volatility). Meanwhile, the CNY's 12-month non-deliverable forward continues to price the yuan at a considerable discount, suggesting that investors expect the currency to be 3.3% weaker one year from now. Finally, the offshore yuan (CNH) continues to trade weaker than the onshore CNY. Although the spread has declined somewhat since before the devaluation in August, numerous reports have indicated that the PBoC has begun to intervene in the offshore market, again suggesting that the CNY is facing downside pressure on all fronts.

The Four Faces Of The Chinese Yuan

China - Exchange Rate, CNY/USD & CNH/USD, CNY 12-Month Non-Deliverable Forward, & PBoC CNY Midpoint

Source: BMI, Bloomberg, PBoC

Authorities Have The Firepower For Now��

At a time when export growth is negative, the real economy is slowing, and China is facing significant financial market stresses following a stock market collapse, it is somewhat confounding that the central bank has stuck to such a strong yuan policy. While the August CNY devaluation shocked markets and even drew the ire of some foreign policymakers, it was very much limited in scale relative to the depreciation experienced by most of the yuan's peer currencies versus the US dollar over the past two years. By the time the dust had settled following the devaluation, the CNY had still appreciated in real effective terms by 14.5% since the beginning of 2014, and by a massive 46.1% since the beginning of 2010 (see chart).

A Blip On The Radar Screen

China - CNY Real Effective Exchange Rate

Source: BMI, Barclays, Bloomberg

The most likely explanation of the central bank's currency policy is that it views its 'stable yuan' strategy as the best way to gain admission into the IMF's SDR basket, which is among the Communist Party of China (CPC)'s foremost priorities. The IMF has consistently indicated to the PBoC that it would like to see a more flexible exchange rate mechanism in order to grant inclusion to the CNY, and the August devaluation came almost directly after an announcement from the group that it would take the unprecedented step of delaying its SDR decision until September 2016. However, downside pressure on the CNY was probably much more acute than the central bank had anticipated, and, as mentioned previously, it was forced to take a step back.

��But Market Forces Will Eventually Lead It Lower

With nearly USD3.6trn in foreign exchange reserves at its disposal, the PBoC has the firepower to keep the yuan steady for an extended period of time. However, we believe that it is more likely that they will allow market forces to gradually play a more prominent role over the coming quarters, which, given the aforementioned factors, should take the currency weaker. The PBoC's ongoing intervention to prop up the currency drains domestic liquidity at a time when the stock market is mired in a deep correction and economic activity is wobbling.

Still Plenty Of Firepower, But PBoC To Avoid Terminal Decline

China - Foreign Exchange Reserves, USDmn

Source: BMI, PBoC

��But Market Forces Will Eventually Lead It Lower

With nearly USD3.6trn in foreign exchange reserves at its disposal, the PBoC has the firepower to keep the yuan steady for an extended period of time. However, we believe that it is more likely that they will allow market forces to gradually play a more prominent role over the coming quarters, which, given the aforementioned factors, should take the currency weaker. The PBoC's ongoing intervention to prop up the currency drains domestic liquidity at a time when the stock market is mired in a deep correction and economic activity is wobbling.

It also expedites the erosion of the central bank's reserves relative to GDP, undermining its ability to address a potential banking crisis or to stabilise financial markets in the event of acute capital outflows in the future, when China's capital controls are inevitably liberalised. Finally, the yuan's strength in real effective terms is a significant headwind against exporters, and it has only held up so well against the US dollar because of PBoC support. As the central bank gradually withdraws its support in order to achieve its stated goal of allowing the yuan to trade more freely, market forces will take the currency towards our end-2016 target of CNY6.8000/USD, restoring some competitiveness.

���_(d��)��

���_(d��)��

������

������ ��픿�

��픿� ��Ĭ��

��Ĭ�� ׃ɫ��

׃ɫ�� ��ɳ�l(f��)

��ɳ�l(f��) ǧ���

ǧ��� �@����

�@����

�����W(w��ng)���� 11010802022788̖

�����W(w��ng)���� 11010802022788̖